The Scottish Licensed Trade Association (SLTA) is pleased to share an update from Gerald Eve on the Scottish Government’s recent Budget announcement and its impact on the business rates system in Scotland. The government has announced the freezing of the basic Uniform Business Rate (UBR) for 2023, which is expected to save businesses approximately £308 million compared to an inflationary increase. The Small Business Bonus Scheme is also being extended and reformed, with 100,000 properties continuing to pay no rates. The SLTA will continue to provide updates and Gerald Eve are available to discuss any specific issues regarding properties and business rates.

Gerald Eve’s Business Rates Update – following Scottish Budget Announcement

This afternoon the Scottish Government published the Draft Scottish Budget for 23/24. Following the Draft Budget announcement, Gerald Eve have summarised the relevant detail below.

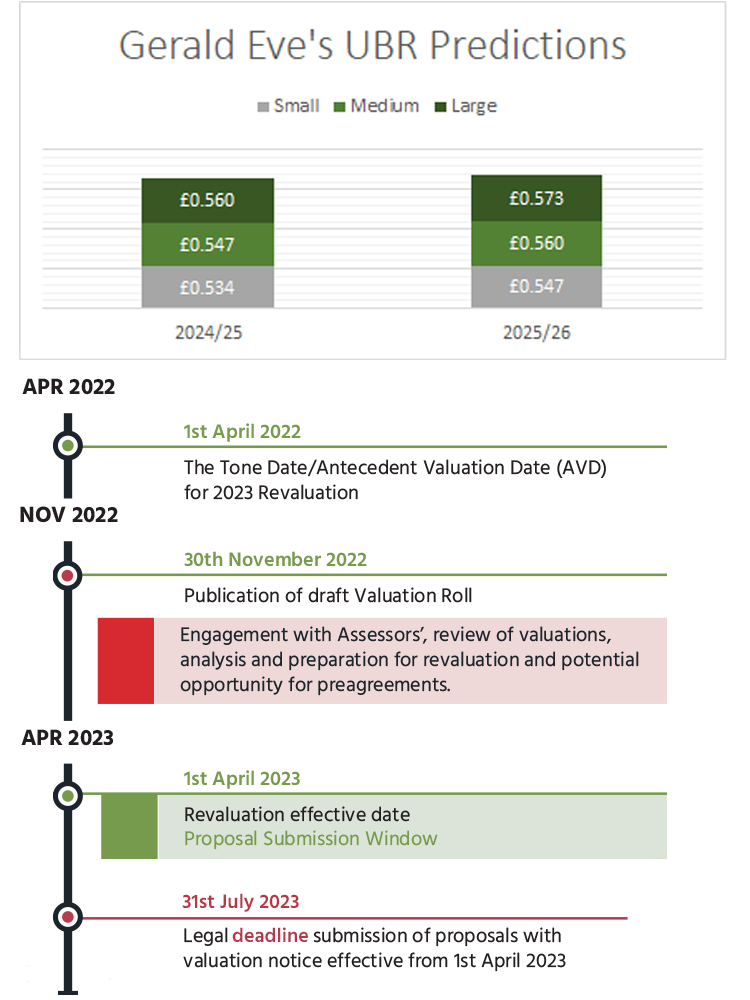

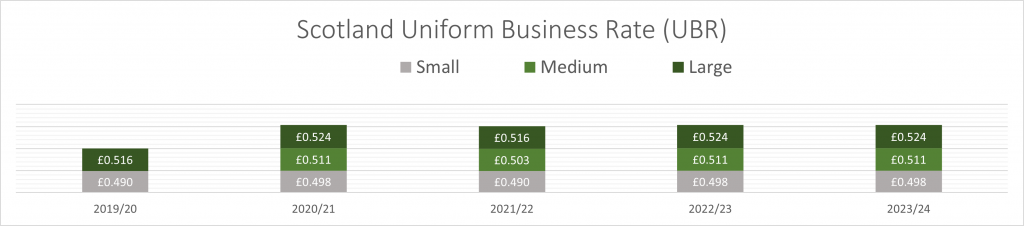

Uniform Business Rate (UBR)

The Scottish Government has formally announced the freezing of the basic UBR for 2023 at 49.8p, avoiding the inflation-based increase that was predicted. This aligns with the budget announcements in both England and Wales. Freezing the basic property rate is forecast to save Scottish Business approximately £308m compared to an inflationary increase.

The large property rate for 2023/24 will apply to properties with a rateable value greater than £100,000

Small Business Bonus Scheme (SBBS)

Small Business Bonus scheme is being reformed and extended with the Finance Minister confirming that 100,000 properties will continue to pay no rates.

100% relief will be available for properties with a rateable value of up to £12,000 and the upper rateable value for individual properties to qualify for SBBS relief will be extended from £18,000 to £20,000.

The Scottish Government are tapering the SBBS relief for properties between £12,001 and £20,000: relief will taper from 100% to 25% for properties with rateable values between £12,001 to £15,000; and from 25% to 0% for properties with rateable values between £15,001 to £20,000.

Other Reliefs

A transitional relief scheme was also mentioned during the budget, and as ever, the devil is in the detail (for example whether phasing will apply to both increases and decreases in liability) and we will report on specifics when more information becomes available.

The Scottish Government announced that there will be a scheme to incentivise investment in renewables through the introduction of new prescribed plant and machinery exemptions for onsite renewable energy and storage. The eligibility criteria for reliefs will soon become clear, with specific detail on eligibility in relation to Subsidy Control.

2023 Revaluation Liability Reports

Following the confirmation of the UBR by the Scottish Government, we will provide updated liability schedules in due course.

Legislation

On Monday 12 December, legislation was passed by the Scottish Government relating to various legislative timescales and procedures relating to the 2023 Revaluation.

The published legislation highlights the complete reform of the Non-Domestic Rates system in Scotland. The changes are now crystallised and engagement with us is essential to ensure there is sufficient time to represent your interests.

Contact us Gerald Eve

Please do not hesitate to contact Gerald Eve if you have any queries: MClarkson@geraldeve.com