The Scottish Assessors have been issuing Assessor Information Notices (AINs) since summer 2021 in order to obtain information they require ahead of the 2023 Revaluation. Since the passing of the Tone date (1st April 2022), the Assessor has been increasing the volume of AINs issued across the country in order to carry out their valuations.

It is imperative that any notice received is directed to the appropriate person within your organisation and acted on within the statutory time limit. Non-return of these AINs can result in significant penalties being issued by the Assessor.

A reminder of the penalties for failure to return information when requested:

Stage 1 Penalty – non return within 28 days from issued AIN could result in a fine of the greater of £200 or 1% of the rateable value of the property at the time (or £1,000 where the Lands and Heritages are not currently entered in the Valuation Roll);

Stage 2 Penalty – non return within a further 42 days from original penalty notice could result in fine of the greater of £1,000 or 20% of the rateable value of the property at the time (or £10,000 where the Lands and Heritages are not currently entered in the Valuation Roll);

Stage 3 Penalty – no return after period of a further 56 days from original penalty notice could result in a fine of the greater of £1,000 or 50% of the rateable value (or £50,000 where the Lands and Heritages are not currently entered in the Valuation Roll)

The penalties are cumulative and where no response is provided a fine of up to 71% of the rateable value could be issued. Any penalty notice issued by an Assessor can be appealed, however there are strict grounds for an appeal which would be determined by a Committee.

Gerald Eve can assist you with completing and returning the notices, in order for us to do so you will need to be able to provide us with all the information required and within the strict time limits in place.

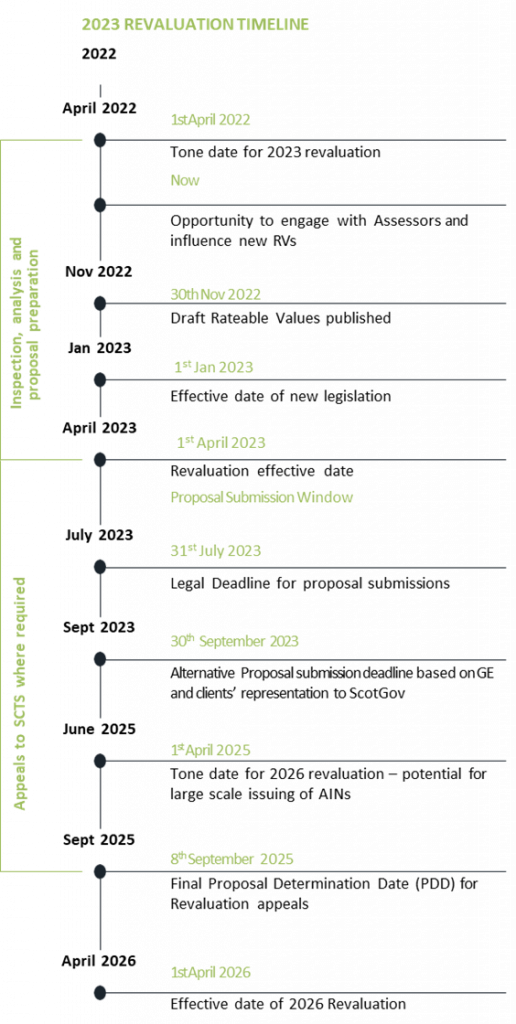

A reminder that the 2023 Revaluation is fast approaching and we will continue to keep you updated on all relevant matters over the coming weeks and months, and as we approach milestone dates and deadlines relative to the 2023 Revaluation.

For more information or support contact Martin Clarkson MClarkson@geraldeve.com