SLTA’s Response to First Minster’s Relaxation of Rules for Pubs and Hospitality Sector. Key Changes to the Job Retention Scheme – KPMG highlight the issues of Job Retention Scheme 2, the Flexible Furlough Scheme. Support “The Ben” – Social Distancing Signage.

SLTA’s Response to First Minster’s Relaxation of Rules for Pubs and Hospitality Sector

The Scottish Licensed Trade Association has welcomed today’s announcement by the First Minister that outdoor hospitality such as beer gardens can reopen from July 6 and pubs and restaurants indoors from July 15. These are indicative dates subject to social distancing rules and public health advice.

Nicola Sturgeon also confirmed that much of Scotland’s self-catering sector can reopen from July 3 and hotels from July 15 – again, subject to social distancing rules and public health advice.

Paul Waterson, SLTA media spokesperson, said that it signalled “much-needed good news” for pubs following last week’s disappointment when the First Minister announced that the hospitality industry would have to wait until July 2 for a provisional date.

He expressed disappointment, however, that there was still no news on a reduction of the two-metre social distancing parameter that has been given the green light by the UK Government for operators in England.

Waterson said:

“Today’s announcement is clearly much-needed good news for pubs but many operators desperately need the two-metre social distancing parameter reduced if they are to be viable.

“That pubs and restaurants can open indoors from July 15, albeit on a limited basis initially and subject to a number of conditions, is also to be welcomed and we look forward to viewing the detailed guidance when it becomes available.

“The First Minister also said today that businesses in the hospitality sector will be required to take names and contact details of customers, and store them for four weeks – we accept that this is both responsible and necessary under the circumstances,” he added.

However, Waterson warned that guidance similar to that issued by the UK Government would prove extremely problematic for operators. “It states that pubs should not provide any entertainment such as live TV broadcasts and loud music that could encourage customers to sing, chant or dance.

“We appreciate that some measures will be absolutely necessary and of course we will work round those and adhere to them but the guidance must be balanced and sensible. Who wants to spend time in a pub when there is no atmosphere?”

Waterson continued: “We said last week that Scotland’s hospitality sector will take a long time to rebuild and recover, and while today’s announcement gives us definitive dates to work towards, make no mistake – there is still a very long way to go with many other issues to be addressed.”

Key Changes to the Job Retention Scheme – KPMG highlight the issues of Job Retention Scheme 2, the Flexible Furlough Scheme

Our key take-away is that there is much more to get to grips with and understand in respect of most businesses’ biggest cost: payroll.

The calculations will be even more complex than ‘JRS 1’, particularly where they relate to employees who work variable hours. Many employers will simply not have available the data on hours worked that is required.

In addition, the emphasis on getting the calculation correct, and the enforcement consequences of not doing so, appear to have intensified and could cause nervousness for employers making claims.

Given the increased media and stakeholder scrutiny over whether it is appropriate to use the JRS, in particular where an employer subsequently makes redundancies, pays dividends or maintains senior executive pay levels; employers should take additional care that any claim they do decide to make is robust.

What does the new guidance say?

As previously announced by the Chancellor, ‘JRS 2’ offers flexibility on part-time working, with a phased reduction in financial support from 1 August.

The JRS guidance is now far more complex, totalling nine main pieces of employer guidance, six of which have been substantially amended (only one remains unchanged) and two of which are new. This is in addition to the Treasury Direction.

Key changes from 1 July are:

Furloughed employees can return to work on a part-time basis while remaining in the JRS – this will require new furlough agreements which deal with more complexity and detail than was necessary under JRS 1.

Employees can only be furloughed on or after 1 July if they:

- Have previously been furloughed for at least three consecutive weeks at some point in time during the period covered by JRS 1 (i.e. 1 March to 30 June 2020); or

- Return from statutory parental leave after 10 June.

For employees who are furloughed on or after 1 July there will be no minimum furlough period. Whilst this flexibility is welcome, in practise it could complicate the relevant calculations and claims.

Claims under JRS 2 can be made from 1 July, and final claims under JRS 1 must be submitted on or before 31 July.

Claim periods must begin and end in the same month (i.e. they will not be permitted to overlap calendar months as they can at present). Where an employee is furloughed for a continuous period that crosses from June into July, two separate claims must be made.

A minimum claim period of one week will apply. However, special rules can allow claims to be made for shorter periods at the start and end of the month if these would otherwise be outside a claim.

Generally, the number of employees included in a single claim made under JRS 2 cannot exceed the highest number of employees included in any one claim submitted under JRS 1. However, employees who are furloughed for the first time following their return from statutory parental leave do not count towards this limit.

Before submitting claims for a period, employers will need to determine furloughed workers’:

- ‘Usual hours’ they would otherwise have worked in that claim period;

- Part time hours worked; and

- Furloughed hours.

For these purposes, there are different methodologies for calculating an employee’s ‘usual hours’ depending on whether they work ‘variable’ or ‘fixed’ hours.

The new guidance includes a detailed methodology for calculating ‘usual hours’, as well as over 30 detailed examples which, whilst helpful, inevitably cannot cover all possible circumstances. It is clear, however, that sourcing the relevant data on hours worked will be key. The recent requirement that payslips record the hours which pay relates to for employees whose hours vary might assist with this (though that obligation might have slipped under the radar for some employers).

What should employers consider?

Employers who participate in JRS 2 will need to identify employees who will be furloughed on or after 1 July, revisit employee communications, and renegotiate furlough agreements with employees who will return to work part time.

The methodology for calculating the ‘usual hours’ of furloughed employees who return to work part time is complex. Employers should ensure they understand the detailed requirements, and that their processes and systems are ready for the new scheme.

Any overclaims should, where possible, be addressed through adjustments to future claims. Where this is not possible, or there has been an underpayment, employers should contact HMRC directly. The new guidance also confirms that HMRC will carry out additional checks where underpayments are claimed. Employers should therefore review historical claims to confirm whether they are correct.

Employers are obliged to pay 80% of reference pay (subject to the appropriate cap) to employees. Those who took a prudent approach to calculating reference pay because of initial ambiguities over its components should revisit these calculations to ensure they haven’t underpaid employees, and that they comply with the rules of the scheme. There are several options open to employers for correcting any underpayments to furloughed employees. It is conceivable that enforcement powers may be handed to HMRC along the same lines as National Minimum Wage enforcement.

We’re working through the new and redrafted guidance and will publish more detailed commentary in due course. We will also be working tirelessly to adapt KPMG’s bespoke JRS calculator, but it will take some time to enable the additional functionality.

For more information please contact Alexander Walker, Associate Director at KPMG on 0141-330-5845 or e-mail alexander.walker@kpmg.co.uk.

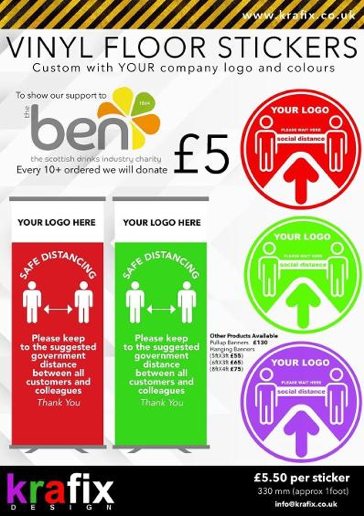

Support “The Ben” – Social Distancing Signage.